moving company insurance

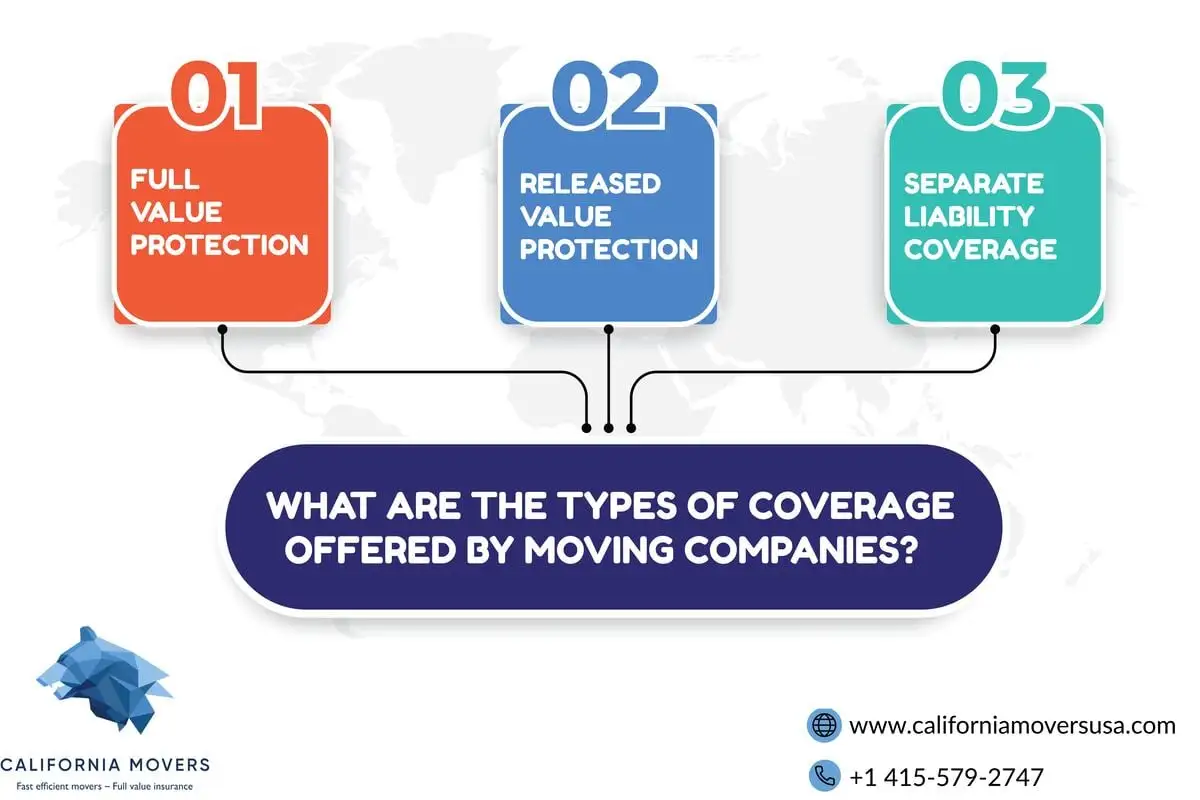

Naturally, there is a moving company insurance that movers are responsible for the items you entrust them with. If you’re moving from a state to another, the federal law requires the moving company to provide two coverage types, and they’re full value protection and released value protection. Also, third-party vendors offer other insurance options.

Full Value Protection

If you have full value protection, your house or local movers are fully responsible for any losses or damage to your belongings during shipping.

To elaborate, so with moving companies insurance, the movers have to replace the damaged item, replace it with a similar item, repair it, or pay you a cash settlement so that you can repair or replace it yourself. Undoubtedly, that renders this coverage comprehensive but costly.

You should note that the moving company reserves the right to decide whether an item is fixed or replaced with a similar one. For instance, if it has damaged your microwave of 1 year during the move, the company may fix it or replace it with another microwave. That one won’t be new, though; it’ll have been used roughly the same period.

As for the reimbursement, its value relies on the valuation of your belongings. So, the cost is about 1% of the valuation.

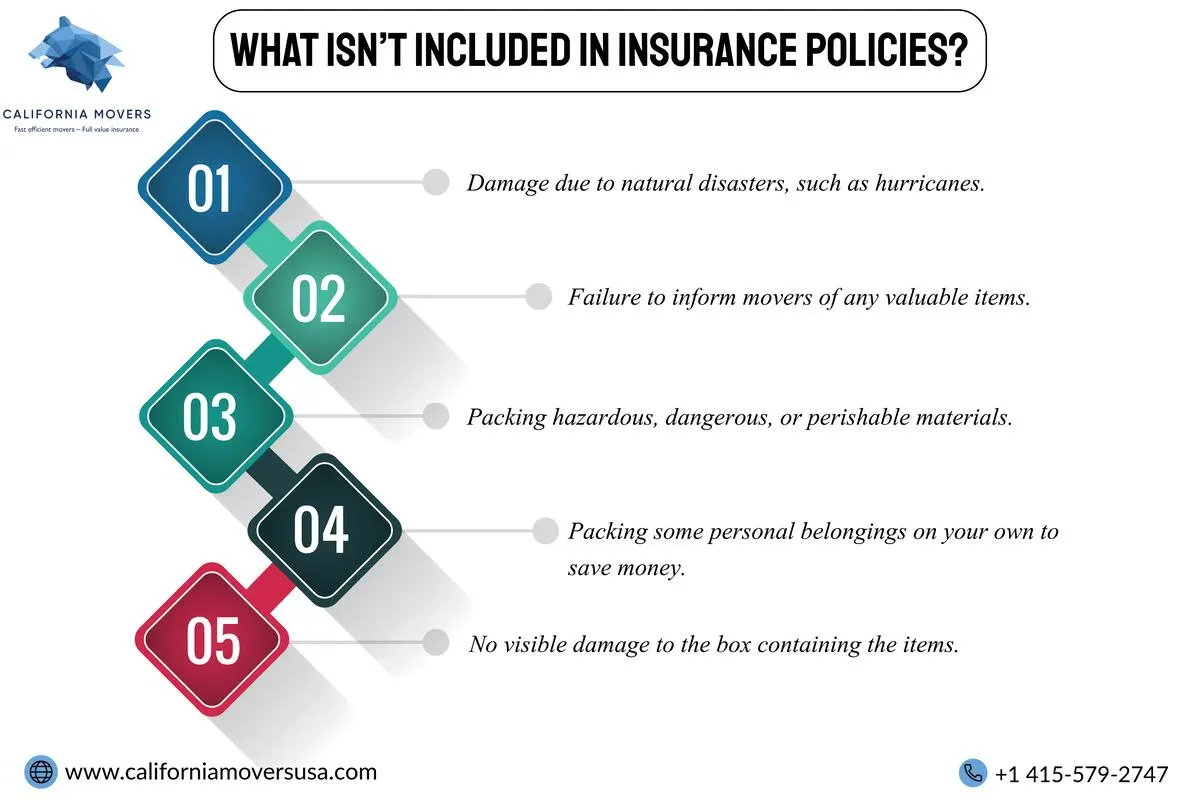

Still, full value protection may not cover everything . For example, moving companies can legally limit their liability for damages, making it so that they aren’t liable for expensive items worth over $100 per pound. Accordingly, that may be the case for jewelry, electronics, and collectibles.

Tip: Ask for your moving company’s specific plan to learn the details and evaluate how it calculates the replacement value. That’ll be especially helpful with highly valuable items. Also, take note of what actions aren’t covered.

Released Value Protection

This is the most basic insurance type. It’s mandatory under federal law, and it’s free. However, where full value protection is comprehensive, released value protection is limited. So, you’ll be compensated for up to 60 cents per pound for each item.

And that coverage is over everything from paper clips to family heirlooms. You’ll find the exact coverage details in the moving company’s quote. Still, 60 cents will hardly be enough to replace or even fix your belongings.

Moreover, a moving company must offer you released-value restitution for any damages. And the minimum rate per pound per item is $0.30 for intra-state or local movers. Otherwise, interstate moves have a higher minimum rate, that being $0.60 per pound per item.